For the Class of 2026, a stable but selective job market means employers are hiring carefully and expecting new graduates to add value quickly

The job market awaiting the Class of 2026 isn’t collapsing, but it isn’t exactly roaring back either.

According to Universum’s 2026 Talent Outlook report released last week, 16% of global companies expect to reduce staffing levels in the first quarter while 16% expect to hire more. Another 40% expect to keep about the same level of workers and 4% are unsure.

“It’s kind of showing that the labor market is stabilizing, but it’s not necessarily accelerating,” Universum Chief Sales Officer Kortney Kutsop said in a webinar about the report’s release.

Net Employment Outlooks — which measure the share of employers planning to hire minus those planning to cut — have improved slightly from the previous quarter, but remain down compared to the same period last year.

In other words, hiring sentiment has ticked up recently, but employers aren’t in expansion mode.

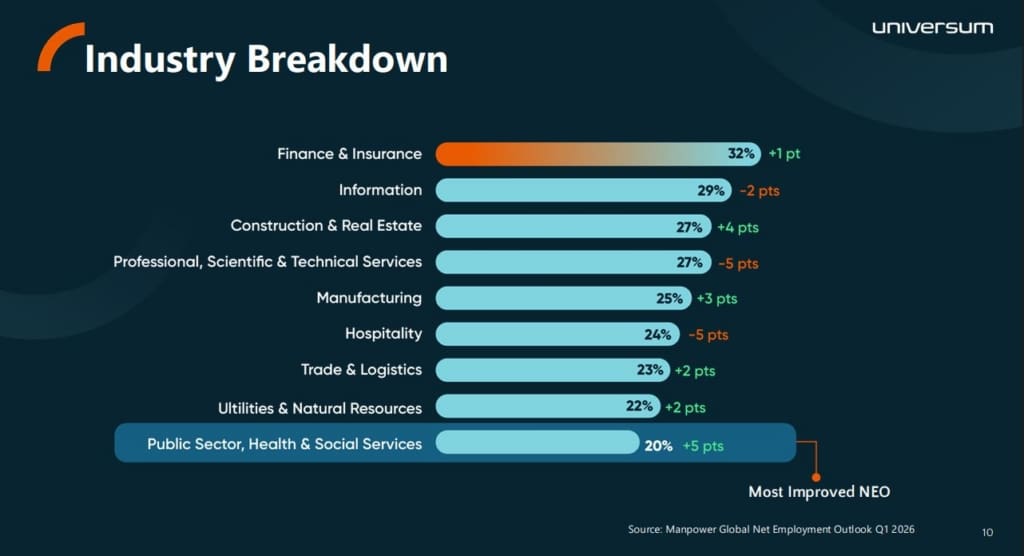

THE INDUSTRIES THAT ARE HIRING IN 2026

Of industries that do plan to hire, finance has the strongest Net Employment Outlook (NEO) at 32%, one percentage point higher than last quarter. It remains one of the most resilient destinations for business students even as employers overall remain cautious.

Information follows with an NEO of 29%, though its outlook has cooled slightly compared to prior periods. Construction and real estate and professional, scientific and technical services are tied at 27%, but for very different reasons: construction is gaining momentum, while professional services is showing signs of pullback, as you can see in the slide below.

Source: Universum’s Talent Outlook 2026

The data shows that even the strongest sectors are signaling restraint. “It’s kind of showing that the labor market is stabilizing, but it’s not necessarily accelerating,” Kutsop says.

Further down the list, manufacturing (25%) shows a modest rebound, while hospitality (24%) and trade and logistics (23%) are softening. Utilities and natural resources (22%) remain relatively stable with slight improvement.

The most notable shift, however, comes from public sector, health and social services, which post the lowest overall outlook at 20% but are flagged as the most improved sector, with hiring sentiment up five points.

Universum — a global employer branding and talent research firm — based its report, in part, on the ManpowerGroup Employment Outlook Survey which tracks employer hiring intentions quarter by quarter and well as its own surveys of global companies and professionals.

AI & THE RISE OF THE ‘SUPERWORKERS’

Artificial intelligence may be reshaping nearly every corner of work, but its biggest impact will come from a relatively small slice of the workforce.

The report defines “Superworkers” as high-performing employees who actively use and develop AI skills, are optimistic about AI’s role at work, and expect employers to enable them to deliver higher-impact output. That group, the report says, represents just 10% to 15% of the global talent pool.

“Superworkers are created where AI adoption is also then supported by leadership, the culture and the learning,” Kutsop says.

“It’s not just about technology … Superworkers want to move faster. They want to learn. They want to have even bigger influence.”

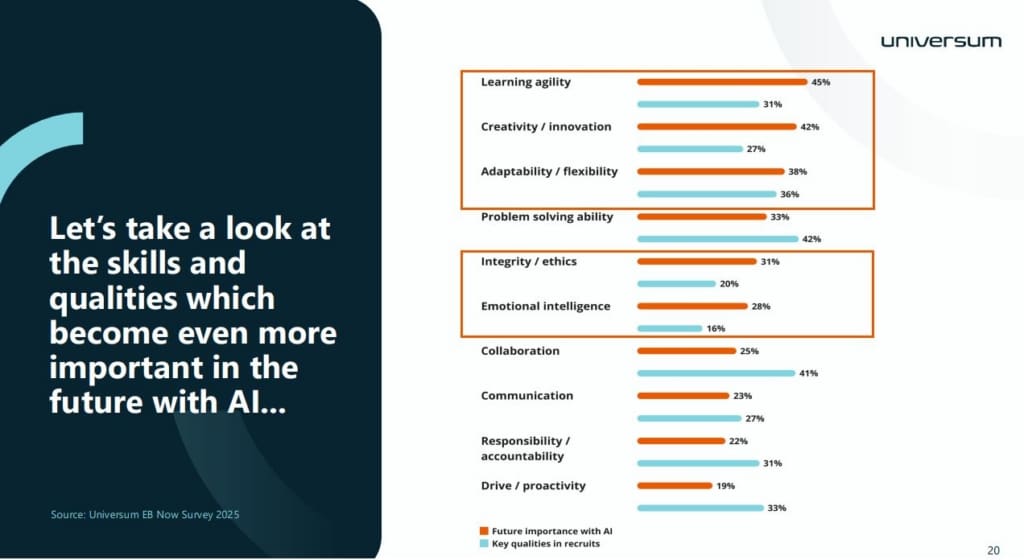

Good news for business schools (and for business students): As AI takes over more routine and technical tasks, employers will place greater value on distinctly human capabilities including agility, creativity and innovation, adaptability and flexibility, problem-solving, integrity and ethics, and emotional intelligence. Competitive advantage shifts toward how students think, adapt, and exercise judgment.

Source: Universum’s Talent Outlook 2026

DISSECTING THE ‘REGRETTABLE RESIGNATION’

Two numbers to watch from Universum’s report that point to continue volatility in the hiring market: 50% of surveyed U.S. tech professionals said they would like to change employers in the next one to two years, while 43% of European professionals indicated interest in changing employers within 12 months, the highest level Universum has seen.

“I think these stats are worrisome,” says Kutsop. “It’s also not just the turnover alone. Of course, we don’t want people leaving, but it’s really who is leaving.”

When strong performers exit, organizations lose institutional knowledge, client trust, and the ability to execute. Remaining employees get asked to do more with less. It’s what employers call “the regrettable resignation.”

“If companies are starting to lay off people, which we are seeing, the good people are looking at this, and they’re saying, ‘Oh, I thought I was gonna stay, but now I’m scared, and I’m gonna leave, too,’” Kutsop says.

In response, employers are getting more surgical. They are segmenting employees by critical skills, performance, and future potential to understand the business impact if specific people walk out the door.

And that puts pressure on managers to stop treating career conversations as an annual ritual, argues Universum Managing Director Claes Peyron. The goal is to intervene early and to make retention feel like recruitment.

For students preparing to enter the workforce, remember that when overall hiring is cautious, mobility pressure remains high. Employers may not be expanding aggressively, but they are fighting harder to keep their best people. That can both open doors for new graduates and raise expectations for those who walk through them.

DON’T MISS: MBA STUDENTS WANT AI IN THE CORE – AND MANY SAY THEIR PROGRAMS AREN’T DELIVERING and HOW ONE BUSINESS SCHOOL IN MINNEAPOLIS IS NAVIGATING THE ICE SURGE

The post ‘Talent Outlook 2026’: Where Jobs Are Growing This Year – And Where They’re Not appeared first on Poets&Quants.