For years, Stanford Graduate School of Business finance professor Ilya Strebulaev has been known as the business school world’s “unicorn tracker,” analyzing how billion-dollar startups are built, who founds them, and which institutions supply their talent.

His latest research, announced via his LinkedIn page, turns the lens on venture capitalists themselves — and how their educational backgrounds influence investment performance.

In a new analysis with Blake Jackson, a Ph.D. candidate in finance at the University of Florida and visiting researcher at Stanford GSB, Strebulaev examined the educational histories and track records of 3,971 senior U.S. VC professionals from 1996 to 2025, defining “senior” as those in director, principal, or partner roles. The findings point to a clear — and in some cases statistically significant — advantage for graduates of a select group of MBA programs.

STANFORD, LBS, HARVARD, COLUMBIA, KELLOGG, WHARTON LEAD

Ilya A. Strebulaev of the Stanford Graduate School of Business: “The combination of brand recognition and performance benefits explains why top MBA programs remain popular recruiting grounds for VC firms”

The study found that partners from several top MBA programs have made significantly more successful investments than the average VC, even after controlling for factors such as work experience, start year, and demographics.

The biggest performance boosts — all statistically significant — were linked to MBAs from:

- London Business School

- Stanford Graduate School of Business

- Harvard Business School

- Columbia Business School

- Northwestern Kellogg School of Management

- The Wharton School

VCs with a Stanford MBA, for instance, averaged nearly twice as many successful investments — defined as unicorns, IPOs, or acquisitions with exit values at least double the total investment amount — compared to their peers.

Four other programs — Cornell Johnson, USC Marshall, Yale SOM, and Michigan Ross — also showed above-average performance, though the differences were not statistically significant.

“These programs likely provide better networks, recruiting opportunities, more relevant coursework, and stronger analytical training for evaluating investments,” Strebulaev writes in a LinkedIn post announcing the findings. “While an elite MBA doesn’t guarantee success, it can provide meaningful advantages.”

FEWER MBAs IN VC OVER TIME

The same dataset also shows a steady decline in the share of MBAs among senior VC investors. Around 50% held an MBA in 2000; today, that figure is 36% and trending toward one-third.

“What has caused such a decline? One of the conjectures is that the VC industry is now covering a much wider spectrum of industries, and there are many more VC firms that specialize in a specific technology or space,” Strebulaev writes.

“This could also suggest that the VC industry has come to value specialists over generalists over time.”

A chart from the study (see above) illustrates just how much the proportion of senior VCs with MBA degrees has fallen. In 2000, 44% of middle- and top-level venture capital professionals held an MBA or equivalent. That figure has steadily declined over the past quarter-century, reaching just 31% for those entering the industry in 2025 — the lowest level in the dataset.

A FEW SCHOOLS DOMINATE THE TALENT POOL

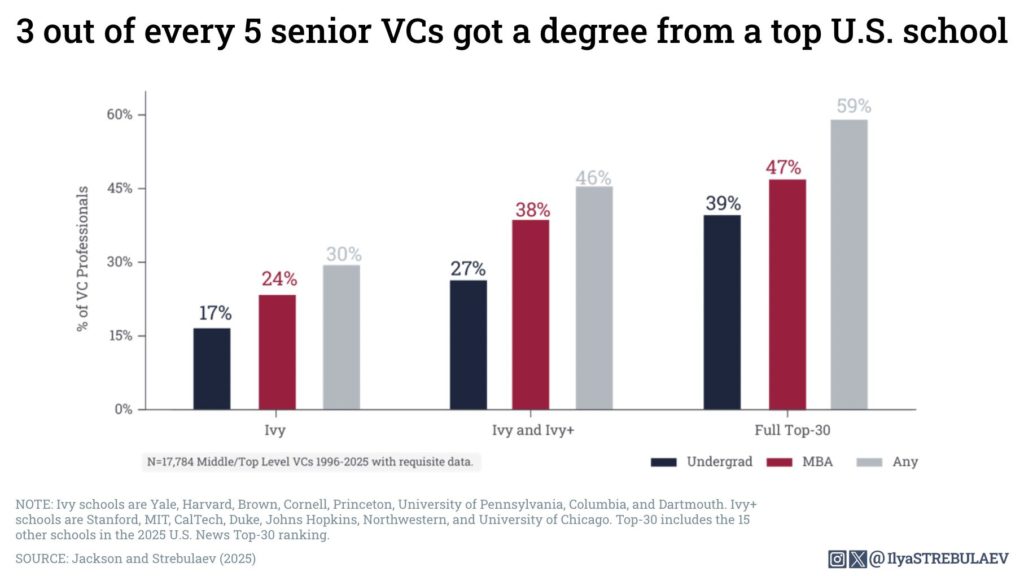

Educational pedigree still looms large in the makeup of the industry’s top ranks. Nearly three out of five senior U.S. VC investors earned a degree from a top-30 school.

Almost half attended an Ivy or Ivy+ university for at least one degree, with 38% holding an MBA or equivalent from such institutions.

“These results clearly show the impact of a select few educational institutions on the composition of human capital in the VC industry,” Strebulaev writes.

CONNECTING THE DOTS: NETWORKS, UNICORNS, AND VC SUCCESS

Strebulaev’s earlier unicorn research underscores the role of alumni connections in venture investing. In a 2023 Poets&Quants feature, we reported that he found “33% of all venture capital deals have a founder and an investor who studied at the same university.” He added: “Interestingly, there is a significant variation in the presence of shared alumni connections in VC deals, even among schools of similar prestige.

For instance, while 45% of the deals involving investors from Harvard also involve at least one founder from Harvard, the figure drops to 20% for deals involving investors from MIT and founders from MIT.”

While that finding does not directly measure investment performance, it illustrates how shared academic ties can shape deal flow — a factor that may help explain why the same schools that top the VC performance rankings also dominate Strebulaev’s unicorn founder datasets.

A NEW LENS ON VC PERFORMANCE

For Strebulaev and Jackson, whose combined work at the Stanford Venture Capital Initiative has become a global resource for data-driven insights on private markets, the new findings add another dimension to understanding how the industry works — and what factors may predict investment success.

“Our data shows that certain MBA programs prepare students better for venture capital success,” Strebulaev writes. “The combination of brand recognition and performance benefits explains why top MBA programs remain popular recruiting grounds for VC firms.”

DON’T MISS 2 U.S. B-SCHOOLS LEAD THE ELITE IN GRADUATING UNICORN FOUNDERS and WHICH COLLEGE MAJOR HAS THE BEST ODDS OF PRODUCING A UNICORN? HINT: IT’S NOT ‘BUSINESS’

The post The MBA Programs That Give VCs A Measurable Edge appeared first on Poets&Quants.